NLIS 1

February 15, 2005

(Government Services)

The following is being distributed

at the request of the Petroleum Pricing Office:

Petroleum Pricing

Office releases maximum fuel prices effective February 15

Maximum regulated fuel prices as of

February 15 will see decreases on all fuels in Newfoundland and

Labrador with the exception of gasoline.

The Public Utilities Board�s Petroleum Pricing Office (PPO) has

determined that effective 12:01 a.m. Tuesday, the maximum price for

all types of gasoline will increase by 0.7 cents per litre (cpl).

Moving downward are diesel prices by 1.5 cpl; No. 2 blend furnace

oil by 0.2 cpl; stove oil by 1.10 cpl; and residential propane used

for home heating purposes will be adjusted downward by 0.7 cpl.

There will be no changes to maximum prices where a price freeze is

in effect.

David Toms, PPO director (acting), noted this pricing change

represents the normal mid-month adjustment of regulated fuels sold

in the province. Pricing over the last few weeks has been influenced

largely by international events involving major oil-producing

countries, which has affected ongoing demand/supply issues.

In addition, Mr. Toms explained the market is entering a period

where a seasonal shift occurs in refinery production. During this

period, production of distillate fuels (home heat and diesel) is

decreased in favour of building inventories for the upcoming season

when automobile travel is greatest. Future pricing of distillate

products could still be adversely impacted depending on the

winter/spring temperatures yet to be experienced and other global

events. But Mr. Toms indicated distillate supplies appear to be

adequate to meet current needs.

The public is reminded that wholesalers and retailers are permitted

to sell below maximum prices at any time.

MARKET MOVEMENT

Market prices leading up to January 30 - the date of OPEC�s

(Organization of Petroleum Exporting Countries) meeting and the

Iraqi elections - were on the rise reflecting an apprehension in the

fuel market about what could happen to available supplies.

However, prices eased slightly after OPEC decided to hold the line

on its output citing strong demand and volatile markets as reasons,

while the Iraqi elections took place without the anticipated

violence or attacks to the country�s oil infrastructure.

Refinery production is beginning the transition from distillate

fuels to gasoline. Even with a sizeable consumption of distillates

in the coming weeks, analysts anticipate there are sufficient

supplies to meet this demand. Also helping to relieve winter supply

worries were the recent warmer-than-normal temperatures in the U.S.

northeast (where 80 per cent of the country�s home heating fuel is

consumed) and Atlantic Canada. This was believed to slow fuel

consumption and allow distillate inventories, which have been at the

bottom end of the average range for most of the winter demand

season, to build.

Oil and refined fuel prices continued to rebound in the period

leading up to February 11 � the last day used by the PPO to

calculate February 15 prices.

Fuel traders were concerned over OPEC�s warning that it could cut

production before its March meeting to avoid a price plunge. As

well, Saudi Arabia�s (OPEC�s largest producer) oil minister stated

that his country will provide enough supplies to meet growth in

demand and keep prices stable, but that had little impact on the

market.

Among other driving factors was the U.S. Energy Information

Administration (EIA) report that oil inventories showed an

unexpected decline.

Keeping the seasonal shift in mind, the EIA stated gasoline

inventories are in a good position, but market prices for this fuel

product have not moved dramatically because demand has grown in

spite of the ongoing high prices. Concerns over how much gasoline

Europe will be able to export this year (as their inventories are

reported to be relatively low and some European refineries are not

geared towards making low-sulphur gasoline) have also supported high

prices for this product.

Another issue affecting fuel prices is the IEA (International Energy

Agency) report that world oil demand will rise faster than expected

in 2005 because of economic growth in China - the world�s second

largest oil user after the U.S. - and other Asian countries.

BACKGROUNDER

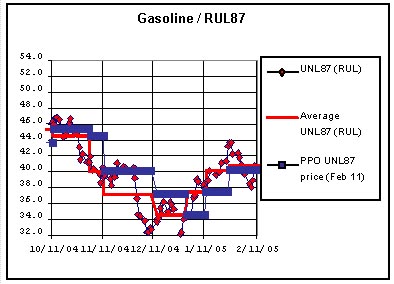

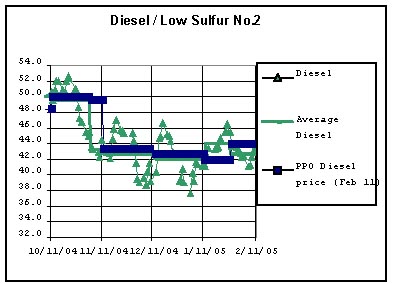

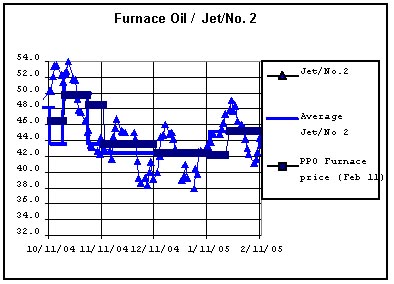

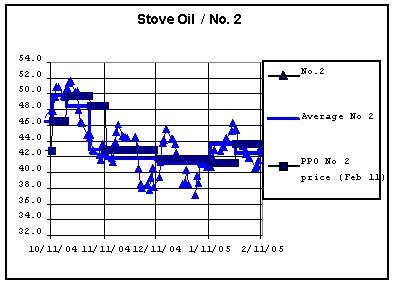

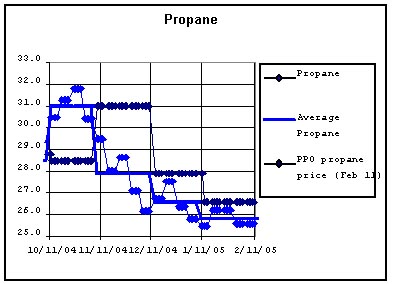

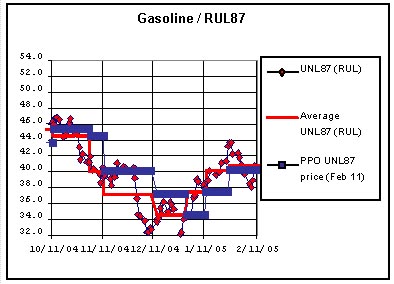

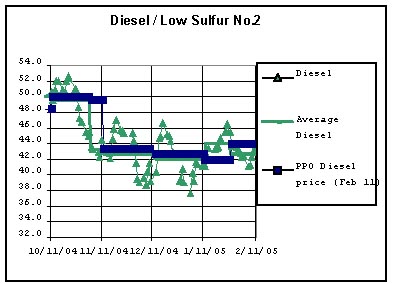

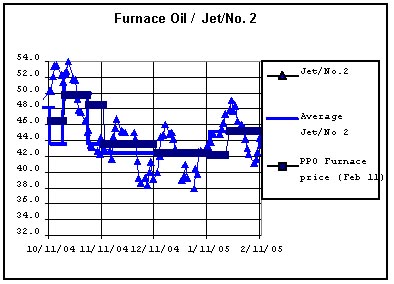

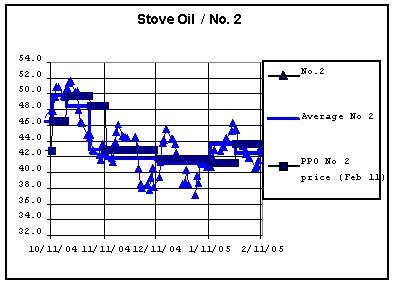

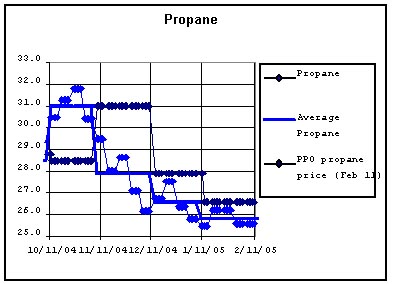

PPO benchmarks are based on the

average price of refined products. Illustrated in the following

graphs are the market-price performances of the five products

regulated by the PPO, for recent regularly scheduled periods up to

February 11, 2005:

Media contact: Michelle Hicks, Communications. Tel: 1-866-489-8800

or (709) 489-8837.

1. Automotive Fuels - Maximum Retail Pump Prices - Effective

February 15, 2005;

2. Heating Fuels - Maximum Tank Wagon (or ** Tank Farm) Prices -

February 15, 2005;

3. Heating Fuels - Residential Propane - Maximum Tank Wagon Prices -

Effective February 15, 2005.

2005 02 15

10:00 a.m. |