|

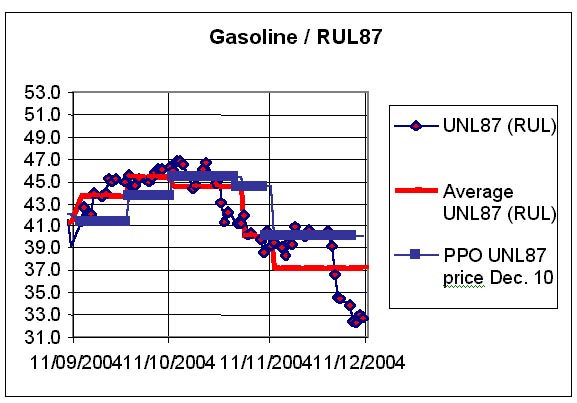

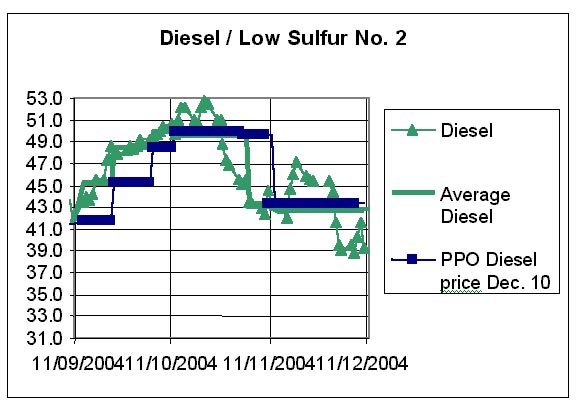

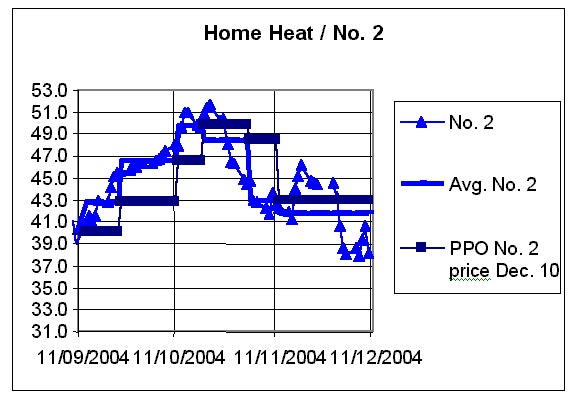

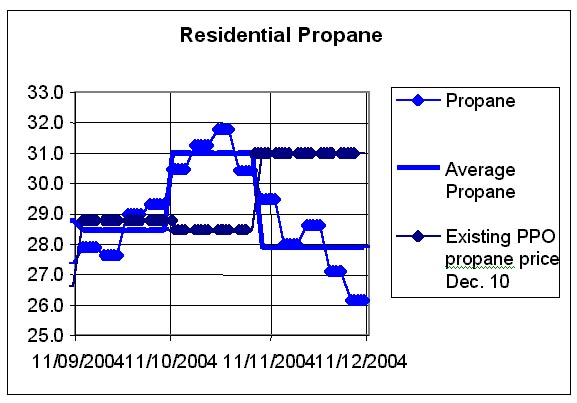

NLIS 1 December 15, 2004 (Government Services) The following is being distributed at the request of the Petroleum Pricing Office: Maximum regulated fuel prices released The Public Utilities Board�s Petroleum Pricing Office (PPO) will decrease prices for all fuels regulated in Newfoundland and Labrador (outside of areas that are currently under a price freeze). Effective 12:01 a.m. Wednesday, December 15, the maximum price for all types of gasoline will decrease by 3.3 cents per litre (cpl); diesel by 0.7 cpl; No. 2 blend furnace oil by 1.14 cpl; and stove oil by 1.17 cpl. Residential propane used for home heating purposes will see a price drop of 3.1 cpl. These are the maximum prices, and retailers and wholesalers can sell below the maximum at any time. The past 30-day pricing period for refined fuels on the world market has been anything but ordinary. The beginning of the session demonstrated high prices for refined petroleum products that, when averaged with the recent declines on the world market in the past week or so, resulted in an overall lowering of regulated prices. David Toms, PPO director (acting), said there may be expectations from the public that there would be larger decreases in prices at this time given the dramatic drops in the crude oil market during the latter part of this period. He explained that regulated prices are not based directly on crude oil performance, but on the market prices for finished or refined products, specifically for gasoline and distillate fuels (home heat and diesel) from the New York Mercantile Exchange (NYMEX), as well as propane. The movement of crude oil prices is not directly proportional to the prices of finished products, which must take into account such factors as refining capacity, level of inventories, and seasonal dependencies. "In accordance with Section 14 of the regulations for the Petroleum Products Act, regulated pricing takes into account the period from when prices were last changed � in this case, from November 12 to December 10 - and not just isolated events," he noted. "Since we last set prices November 15, commodity prices, with the exception of propane, started moving below the PPO benchmarks only in the last part of this regulation timeframe. The interruption formula criteria were not met before the cut-off point." Mr. Toms emphasized that should market prices move such that the criteria for the interruption formula are met, the PPO will act accordingly and decrease maximum prices, just as it would do if there were an increase. "This formula is used in an objective, consistent and fair manner for price increases and decreases," said Mr Toms. MARKET MOVERS Since the PPO last set maximum fuel prices November 15, there was some upward pressure on prices that resulted from the concern that available oil supplies wouldn�t compensate for the ongoing disruptions to the market from some of the world�s major oil producers. Specific examples include: Norway, where production was cut because of a gas leak; Nigeria, where militants stormed pumping stations and halted output; and the Middle East, where attacks continued to threaten oil production. Also placing pressure on fuel prices were the slow recovery of crude oil on the market, as well as the lower-than-average supplies of distillate fuels (home heating fuel and diesel) in advance of the onset of winter. Inventories for petroleum products have also rebounded. Many refineries that were shut down for routine maintenance have returned to normal operations and production rates are at high levels � reportedly the most since Hurricane Ivan forced shutdowns in September. A key factor in helping to replenish distillate inventories was the relatively mild weather in the Atlantic region and along the northern eastern U.S. (the largest area of home heating oil consumption). As a result, recent demands for these products were less than anticipated. When looking at other products regulated by the PPO, gasoline supplies have risen to levels not seen since August and inventory builds for propane have been strong. This activity has assisted in lowering the price for these products at this time. Internationally, OPEC (Organization of Petroleum Exporting Countries) members have been pumping the most oil in 25 years in order to meet a thriving demand. This has secured traders� concerns about available supplies on the market. However, at its December 10 meeting in Cairo, OPEC decided to cut one million barrels of surplus production per day because members believe the market to be well supplied and they wanted to avoid an "extraordinary build-up of inventory levels" (Reuters, December 10, 2004). BACKGROUNDER PPO benchmarks are based on the average price of refined products. Illustrated in the following four graphs are the market-price performances of the four products regulated by the PPO, for recent regularly scheduled periods up to December 10, 2004:

As well, the PPO uses its interruption formula whenever market prices for regulated fuels meet a certain criteria, provided making the early adjustment doesn�t interfere with the regular pricing schedule. For the interruption formula to be used on gasoline and distillate fuels, the PPO requires the average of market prices to be 3.5 cpl greater or less than the current PPO benchmark prices (except propane, which requires +/- 5.0 cpl) over five market business days. Media contact: Michelle Hicks, Communications. Tel: 1-866-489-8800 or (709) 489-8837. 1.

Automotive Fuels - Maximum Retail Pump Prices - Effective December 15,

2004 2004 12 15 9:40 a.m. |

||

|